Average Cost Interval What Is It, Formula, Example

Nevertheless, quicker funds might also indicate missed opportunities to utilize supplier credit for working capital wants. The average payment interval method is calculated by dividing the period’s common accounts payable by the derivation of the credit score purchases and days in the interval. The common assortment period https://www.simple-accounting.org/ signifies the effectiveness of a firm’s accounts receivable management practices. It is essential for firms that closely rely on their receivables in relation to their cash flows. Businesses should manage their average assortment interval if they wish to have enough cash readily available to meet their monetary obligations.

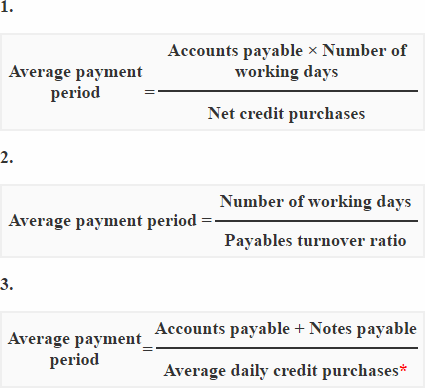

Common Cost Period Formula Components

In The Meantime, investors might interpret a longer cost period as an indication of a company’s strong bargaining position or, conversely, as a pink flag for financial distress. The common cost interval (APP) is a measure of the time it takes for a corporation to pay off its creditors. The enterprise managers need to steadiness these components for efficient management of the common payment interval. If managers are extra centered on managing working capital with the accounts payable financing, the business may be more worthwhile in the quick time period because of extra liquidity.

With perspective to profitability, a prolonged average period is fascinating as it helps to boost working capital management. Nonetheless, there are particular drawbacks of the common cost period, like it does not think about qualitative elements of the relations with the suppliers. It can be a fascinating credit score policy if the business has a better price of return as some quantity of revenue given as a discount is not anticipated to impact significantly influence on revenue.

Steps To Calculate The Common Payment Period

It’s not just about paying invoices on time; it is about optimizing the company’s financial strategy to maintain liquidity, foster strong supplier relationships, and improve operational effectivity. By understanding and managing this ratio successfully, companies can place themselves for long-term financial success. To find out the typical payable period the first step is to search out out the account payable turnover ratio or whole accounts payable turnover (TAPT). This may be calculated by referring your financial statements and steadiness sheets. Accumulate all of the purchases that you’ve got made during a yr (or a period of your choice) and divide it by the typical accounts payable throughout the same time interval.

On the opposite, some businesses believe in payable stability as sturdy input within the working capital and apply to take care of common payment period as long as possible. In other words, the credit score purchases are measured across the fiscal period, so the common accounts payable stability is normally used. The average cost interval counts the number of days it takes a company, on average, to repay its outstanding provider or vendor invoices. Factors like business norms, bargaining power with suppliers, internet terms, and the corporate’s total monetary health are vital in figuring out the common payment interval.

On the opposite hand, if the corporate extends its fee period an extreme amount of, it risks damaging supplier relationships and probably incurring late fees or interest expenses. It aids in figuring out if the agency is taking longer to pay its debts relative to others in the industry, which might point out a liquidity disaster or poor money management. In distinction, a shorter common payment period might mirror the company’s superior operational effectiveness.

Before you proceed with the actual calculation process, you have to locate the accounts payable information, which is current on the stability sheet – beneath the present liabilities section. As a rule of thumb, the common cost period is decided by utilizing a year’s worth data. However, it could possibly be actually useful to do an analysis on a quarterly basis, or over a particular timeframe. Also known as an important solvency ratio, the common payment interval (APP) assesses how much time it takes for a enterprise to pay its distributors, in the case of purchases made on credit.

Permits Traders To Gauge Credit Worthiness

- By rigorously managing the time-frame in which payments to suppliers are made, corporations can effectively control their working capital and improve their general financial stability.

- The average accounts payable value within the formulation is the typical of the accounts payable’s starting and ending balances.

- The sooner the client can gather the loan, the earlier it’ll have the capital to make use of to develop its firm or pay its invoices.

The state of the business’s accounts receivable and excellent buyer funds, which are essential elements of its revenue, aren’t taken into consideration by this metric. For occasion, a company’s accounts receivable stability may point out that purchasers have finished a buy order but not yet finished the fee cycle, deferring precise payment to a later time. Nonetheless, the APP doesn’t consider this potential cash circulate when figuring out whether or not the company can afford to pay its money owed. A management often uses this ratio for establishing whether paying off credit score balances quicker and receiving reductions may truly benefit the corporate or not. But it’s crystal clear that the common fee interval is a critical factor, particularly when it comes to assessing the firm’s money move management. Thus, it is extremely beneficial to investigate other companies’ metrics in your specific trade.

From the perspective of a creditor or provider, a shorter APP is preferable as it ensures faster cost, reducing the credit risk and enhancing cash cycles. Nevertheless, from a company’s viewpoint, an extended APP can be useful as it allows the company to make use of the cash available for other operational wants or funding alternatives. It’s a delicate stability, as stretching the payment interval too lengthy can lead to dissatisfaction among suppliers and may even disrupt the provision chain. From the attitude of a monetary analyst, an extended common fee period might signal that an organization is using its suppliers to finance its operations, which might be a strategic transfer to optimize money flow. Nevertheless, from a supplier’s viewpoint, extended cost terms may pressure the relationship and have an effect on their own money move.

Opening and shutting balance of accounts payable for XYZ firm amount to $20,000 and $30,000 for the yr ended June 31, 2021. Let’s analyze the idea from suppliers’ perspective as they are main stakeholders within the common cost interval of the business. Once More, there are two sides of the equation the place profitability and liquidity act in a reverse direction. Once you get the statements you look at the years beginning and ending account payable balances. Last year’s starting accounts payable stability was $110,000 and the ending accounts payable balance was $95,000. Over the course of final year, the company made a total of $1,110,000 purchases on credit.

The common fee interval calculation can reveal insight a few company’s cash circulate and creditworthiness, exposing potential considerations. Or, is the company utilizing its cash flows successfully, profiting from any credit discounts? Subsequently, traders, analysts, creditors and the enterprise management staff should all discover this data useful. The average cost period is the time the enterprise takes to pay off its collectors.

Leave a Reply